Defaults in Green Electricity Markets – Preference Match not Guaranteed

Defaults, nudging you into a specific behavior if no active choice is taken, are popular in various fields like for instance organ donation or healthy food displays. Several electric utilities have now started to sell green electricity via default contracts. Such defaults are intended to increase the demand for more environmentally friendly electricity.

Furthermore, defaults are supposed to help individual consumers with positive preferences for green electricity to act according to their preferences without having to take the effort to actively make this decision. Hence, a green default may increase their welfare.

The Chair of Economics shows that the green electricity defaults cannot guarantee a match with individual preferences for electricity mixes. In an incentivized laboratory experiment preferences for electricity mixes are elicited. Subsequently, the study assesses whether preferences in the absence of default options match the preferences in the presence of default options. Hereby, two elements from existing electricity markets are considered: costly opt-out of contracts and green electricity certificates through which the production of green electricity is induced.

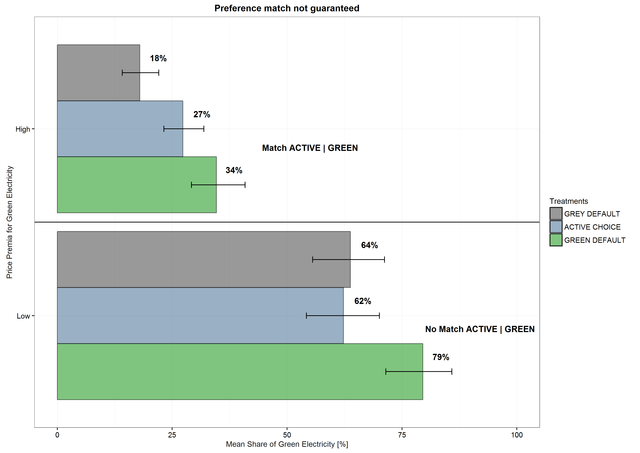

It turns out that there are price ranges for electricity in which individuals stick to green defaults although these individuals do not prefer green electricity over conventional or “grey” electricity (comprising fossil or nuclear energy). Low priced green electricity defaults, as currently applied in several electricity markets, do not match subjects' preferences (see lower half of the figure: subjects choose significantly more green electricity in presence of a green default as opposed to an active choice). However, at higher prices for green electricity, green defaults match with preferences in a choice situation without a default (see upper half of the figure: subjects choose similar amounts of green electricity in a choice situation with a green default and an active choice). Obviously, higher prices for green electricity incentivize people to take an additional effort to act according to their preferences.

Our findings are relevant for the design of green electricity defaults. The often assumed implicitness that defaults always bring along a win-win situation, i.e. an increase of the public good and a match in preferences, has to be put into question.

This research is supported by the Swiss Federal Office of Energy (SFOE) under the research program `Energy - Economy - Society (EES)'. A working paper version can be found on the external pageSocial Science Research Networkcall_made

The ESC member involved in this project is Prof. Renate Schubert. The research and teaching activities of the Chair of Economics focus on explanations of individuals’ and groups’ behavior towards energy and the natural environment, on impacts of this behavior as well as on recommendations for welfare-increasing interventions.